Overview

In every organization there is typically a set of financial functions that sees to the key financial aspects of the business. One of these is the Accounts Payable function. Accounts Payable sees to it that the organization is paying its suppliers and vendors appropriately, but it is also an important tool for understanding the financial commitments of the organization, what future cash flows will look like and whether the organization is optimizing its spending.

Accounts Payable represents the commitments an organization has made on expense items it acquires to produce whatever it is producing. These are typically items such as raw materials and components that go into the products it produces, especially if it is a manufacturing operation. Although, indirect goods such as office supplies also fall into the category of Accounts Payable, they typically are much smaller in impact to the organization’s cost structure.

There are a variety of payment terms offered by suppliers with the most common being either 2/10 Net 30 or simply Net 30. 2/10 Net 30 means that if the payment for the service or items is rendered within 10 days of it being provided, the payer will discount the payment by 2% thus the purchaser will only have to pay 98% of the value of the item or service. The Net 30 indicates that the payer must pay the entire amount within 30 days of receiving the item or service. Beyond these time frames organizations typically will begin to charge some amount of interest on payments that fall beyond these time frames.

Payment terms can vary significantly by industry or trade practice. Working with a fast food company years ago, they indicated that they typically paid for many of their raw materials (i.e. hamburgers, buns, and french fries) between 60 and 90 days after they had received them from their supplier. The CFO commented to me, that the customer had already consumed the product, before they ever paid the supplier who actually produced it. Their contention was that due to the narrow margins and cost competitiveness of their industry, it had to be that way or they would never make any money. Such practices are not typical and most manufacturing companies do not enjoy such liberal payment terms from their suppliers.

This time increment from the time an organization receives items from their suppliers until they must pay the supplier is called the Payables Deferral Period. As described above, this period is often around 30 days if the organization wants to avoid any additional interest expenses and charges from their suppliers. Managing to this timeframe is an important metric for an organization to track if they want to ensure they are not incurring extra expense in the operation of their business. Typically businesses will examine not just the initial 30 day period of payment, but they will break payment periods into additional 30 day increments. Thus they will track 30 day, 60 day, 90 day and even longer periods to understand how they are performing against these metrics.

Finally, having some idea of the commitments an organization has already made can be an important means of understanding the future cash and payments requirements that organization will need to be able to service.

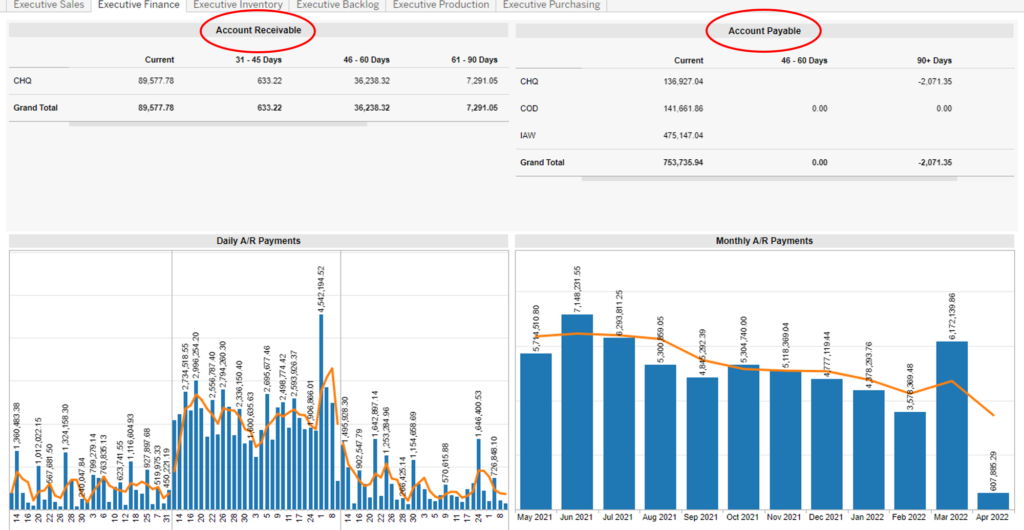

Financial Overview

The first thing a Finance Executive will often want to look at is what is the overall state of the Finances from an Accounts Receivable and Accounts Payable perspective. Below in Figure 1 is an Executive Finance dashboard. This gives a Finance Executive a quick look at these two important areas of Accounts Receivable and Accounts Payable (see red ellipses below in Figure 1.) This quick high level look allows an Executive to see the timing of payments coming in (accounts receivable) and commitments (or accounts payable) that need to go out

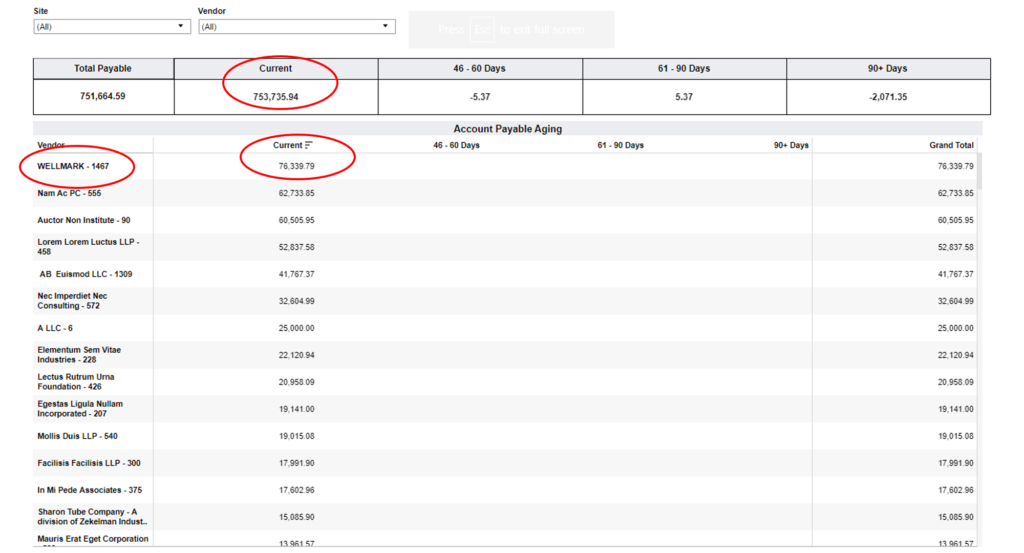

Accounts Payable Aging

Another key metric that an Finance executive may want to review is what is the status of the Account Payables? Are we in arrears anywhere? Or are we keeping up with the payments as they come in? One way to do this is look at an Accounts Payable Aging Report such as is illustrated below in Figure 2. This is a tabular type of report and as such could be downloaded into a spreadsheet and the data could then manipulated or analyzed as with any spreadsheet. In this case though there are some things that could be done with the data in the actual dashboard. Those include sorting by columns to understand what are the top Vendors to which an organization would owe payment. Below in Figure 2. Is an Accounts Payable Aging Report in the upper red ellipse we can see the Current Amount of Accounts Payables. (i.e. due in 0 to 45 days). There are nominal amounts owed in the 45 to 60 time period and 61 to 90 day time period. Actually these amounts are negative, which would indicate the organization has overpaid on some bills and is actually due money back. In the 90 day plus category we also see a negative number, which again indicates we perhaps overpaid on some accounts. As these are small amounts they may not warrant action, but if larger amounts were due then action would certainly be appropriate. Looking at the detail below, we have clicked on the Current column which sorts the column from highest to lowest amount (see red ellipse below right). Then in the left hand column we see the Vendor name (see red ellipse below left). In this example we see the company name Wellmark and that we owe them over $76,000. Comparing this to the total owed in the table above, this represents over 10% of our Current Accounts Payable owed to a single vendor. While there is nothing to be alarmed by in this Accounts Payable Aging Report, this capability to see what we owe and to whom we owe it to, is valuable in understanding our relationship to our Vendors..

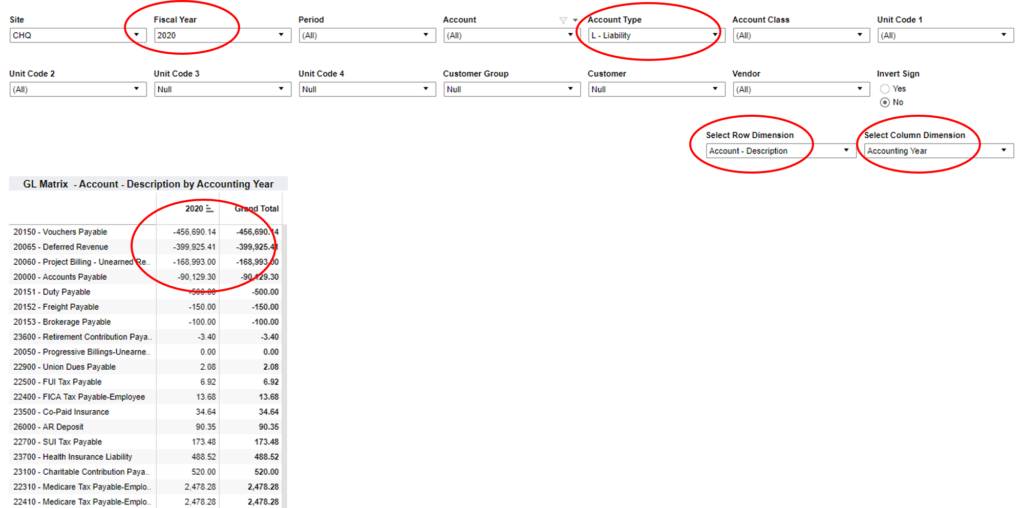

General Ledger Matrix by Account and Year

Another report that might be valuable to a Finance Executive is being able to see Accounts from the General Ledger for which the organization owes payments. In Figure 2 below we can see such a report. In the upper red ellipse we can see that we have selected only the Account Type marked L or Liability. Then in the two red ellipses to the right we have arranged the rows to represent the Account Description and the columns to represent the Year. In the red ellipse to the upper left we see that we have narrowed the year down to just one year in this case 2020. Finally we have sorted on the Year column so that the different Accounts for which the company owes payments are sorted from high to low values. In Figure 2 below we can see that we highest payment category is Vouchers Payable, followed by Deferred Revenue, then Unearned Project Revenue, followed by Accounts Payable. In this example we can see all of the relevant Liabilities the company has by Year and by Account.

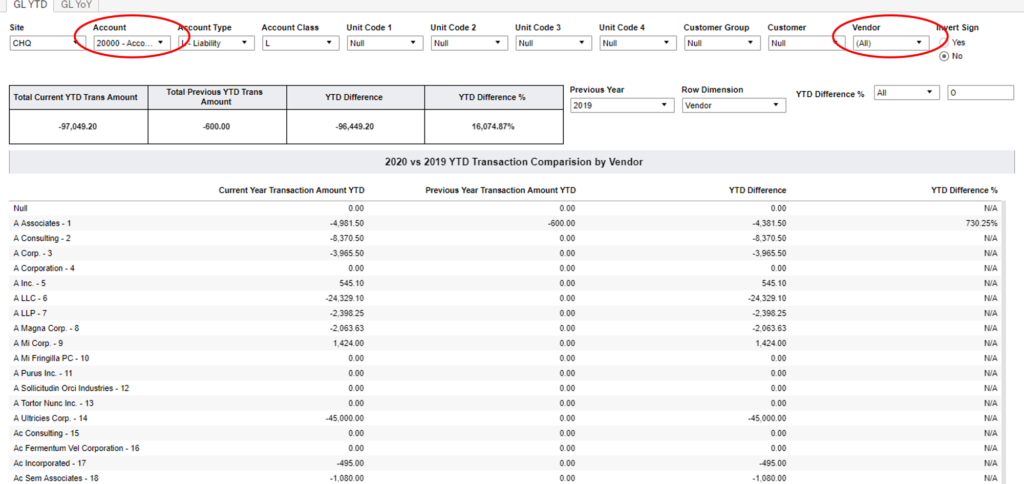

General Ledger YTD Accounts Payable Comparison

Another area of analysis a Finance Executive may want to examine is looking at what are their Accounts Payable Liabilities by Vendor from Year-Over-Year and what they may be Year-To-Date. In Figure 4 below we see a report show this data. In Figure 4 below we see just Accounts Payable data (see red ellipse to the upper left). Then we can see this data is arranged by Vendor (see red ellipse to the upper right). The data below is sorted alphabetically from A to Z. What is illustrated is only a small fraction of the Vendors, as to include any more would result in a very long list. What is important to note about this data is that it allows the Finance Executive see the spend with a given Vendor through the Year-To-Date perspective, but also to see a comparison of that spend from the prior year at the same point in the year. From this one can see which Vendors are seeing the most spending from the organization and how that may compare to the spending in a prior year. This view is sorted alphabetically, but could be sorted from high to low spend by either the current or the prior year’s spending.

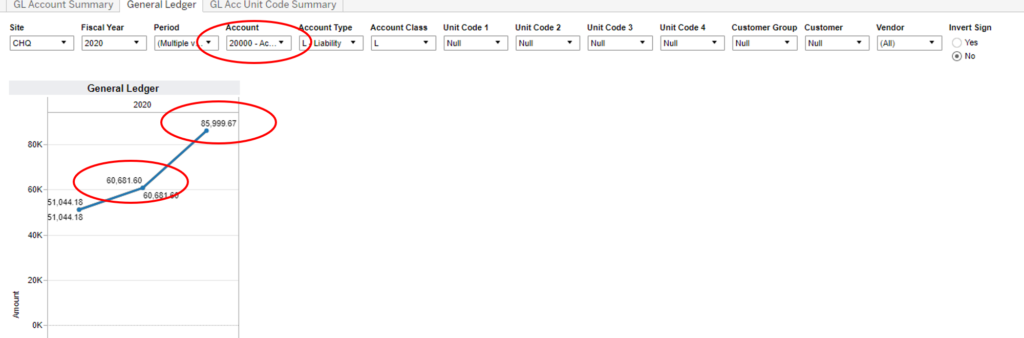

General Ledger – Accounts Payable Trends

Next we will look at how a Finance Executive can look at the general trends in Accounts Payable over time. Below in Figure 5 we see data pulled from the General Ledger but only for the Accounts Payable GL account (see upper red ellipse below) which is for Account 2000 the Accounts Payable account in the General Ledger. Below this has been plotted for the first three months of the year 2020. We can see below that the trend line is up over the first three months of the year 2020. In month 2 the spend on Accounts Payable was $60,681 and in the 3rd month this went up to $86,000 (see two lower red ellipses below). Of course whether either of these numbers should be a concern is not apparent, but the dashboard below presents the data regarding the organization’s spending for Accounts Payable in an easy to see and understand graphical format.

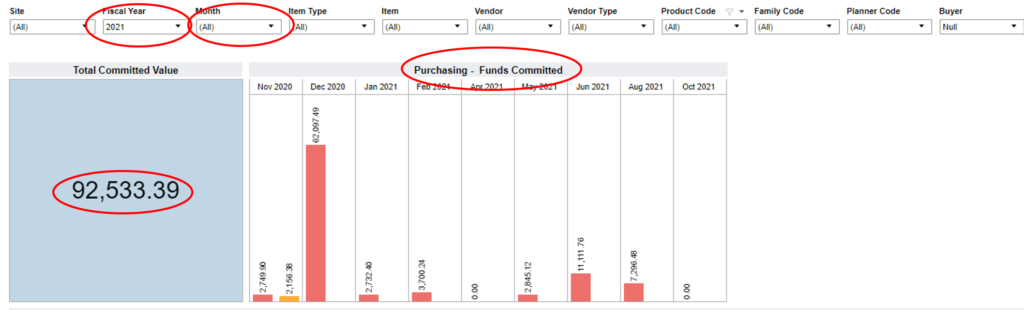

Purchasing Funds Commitment

One important metric a Finance Executive may want to examine are what financial commitments has the organization already made and what do those look like over the near future. In a manufacturing organization the commitment of future funds is often related to raw materials and components needed for the manufacturing process. Many of these items are acquired via the Purchasing Process using a Purchase Order. The commitments that have been made through these Purchase Orders can be tracked and understood especially as a Finance Executive may want to understand these over the next several months or quarters. In Figure 6 below we can see this commitment displayed via a dashboard called Purchasing Funds Committed. In this dashboard the time period is a Fiscal Year that begins in November (see red ellipse upper left). We are then looking at all the amounts that have been committed on all outstanding Purchase Orders for the next 12 months (see red ellipse upper right). These commitments are then broken down by month in the bar graph below (see red ellipse lower right). Lastly the total amount committed over this year is displayed as $92,533 (see red ellipse lower left). This particular snapshot provides insight not only into what the outstanding Purchase Orders are, and thus the Account Payables commitments for these periods, but also how that is likely to play out over time. This dashboard can be thought of as providing a “headlight’ view into what the organization will be spending over future time periods.

Summary

We have looked at some key metrics in the above discussion that a Finance Executive may need to understand in regards to the Accounts Payable activity that is occurring in the organization. We first looked at an overall Financial view of what the Accounts Payable and Accounts Receivable activities are and what are the timing of commitments for both Accounts. Then we drilled into the Accounts Payable detail via an Accounts Payable Aging Report to see what was owed to each Vendor and whether we were staying current on those Payments by Vendor. Then we looked at the organization’s General Ledger and narrowed our view to just the Liability Accounts in the General Ledger to see what the organization might be spending across all of these Accounts. Then we examined our Year-To-Date spending in Accounts Payable by Vendor and compared the Current Year to a Prior Year. We also looked at a trend chart to see what our spend has been in Accounts Payable over a specific time period. Lastly we examined what commitments have been made via Purchase Orders to our Vendors over the next 12 month period and hence will appear as Accounts Payable commitments in the coming months. .

Each of these dashboards enables a different perspective for the Finance Executive to understand the status of the organization and its commitments, plans, and expenditures related to Accounts Payable. These represent only a portion of the capability that is available from IntelliDash. Reach out to us today and we can explore these capabilities in more detail with you.